News and stories about financial education and Just Finance Foundation

News, stories and updates

Pensions: The Motherhood Penalty

On average, women across the UK have 38% less in their pension pots than men. For those over the age of 50, the gap is worse: 46%. In real money, that’s £52,592 in men’s workplace pension pots and £28,249 in women’s. This is more than double the gap for savers under the age of 30. So, what’s happening over those 20 years? And how can we change it?

Buy Now Pay Later - Is it worth it? You decide.

Buy Now Pay Later is an option to delay payment of items. Recently the FCA had to step in to tackle some unfair terms. Read our article to find out more.

Could these tricks save YOU £150 per year on your energy bills?

Just Finance Foundation collates some information to help you save up to £150 on your energy bills at home

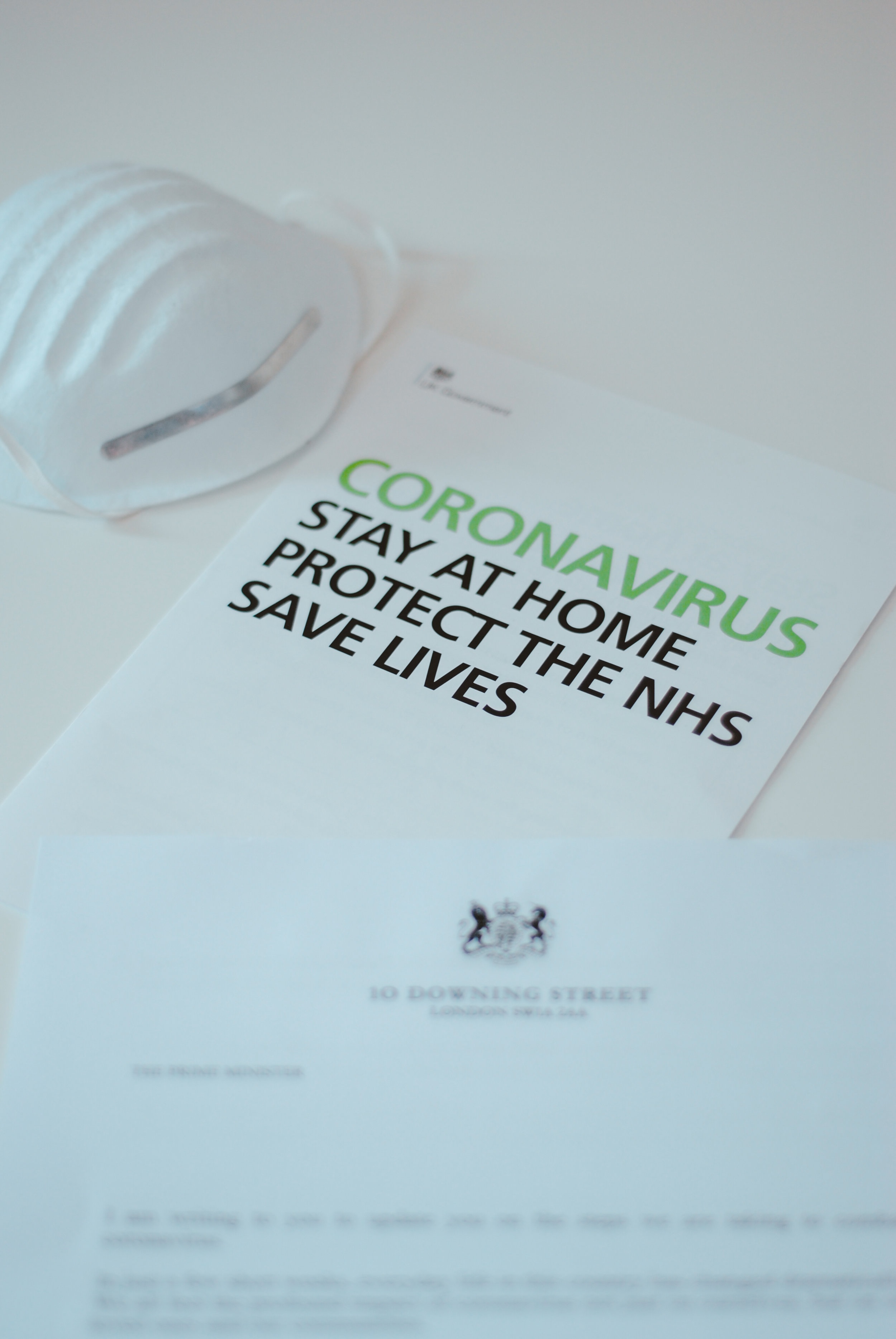

COVID Cash Course Helps Over 30,000 In Need

Since the pandemic began, many families and communities across the UK have been thrown into financial chaos. Over a quarter of households have faced a reduction in income (Bank of England); issues of unemployment, furlough, Universal Credit, bills and arrears have impacted millions of families.

Through an Allchurches Trust grant, the Just Finance Foundation was able to expand its COVID Cash Course, an information and signposting workshop, empowering churches and community leaders to help their communities through a train-the-trainer model. This has now benefited over 30,000 individuals in need of signposting, resources, and accessible financial information.

Klarna: On Borrowed Time and Money?

Whilst buy-now pay-later have become a popular payment method for thousands of consumers shopping online, there have been anxieties and increasing debt concerns when having to pay monthly installments. Payments through buy-now-pay-later reached £2.7bn in 2020 alone (The Guardian).

5 Forgotten About Ways To Support Your Money This Lockdown

It’s a new year and a new lockdown.

You may be feeling worried, apathetic, angry or a mixture of many emotions.

Here are five (often forgotten about) ways that you could put pounds back into your pocket this lockdown, which we have taken from our COVID Cash Recovery course:

The Final Piece In The Jigsaw For Fighting COVID-19?

In Alford, a small Lincolnshire town 11 miles away from Skegness, a local community have been fighting back against COVID-19.

The ‘Alford Hub’, a support network with 90 volunteers, have been offering socially distant befriending, prescription delivery and other vital support to local people in Alford ever since the Coronavirus pandemic transformed our everyday lives in March.

Just Finance Black Country Team Up To Support Financial Resilience!

Our colleagues in the Black Country have launched a new campaign to improve the financial health and resilience of employees across the Black Country, and encourage workforce savings through credit unions.

Why 1st September 2020 Is An Important Date For Millions

Today (1st September 2020) marks a significant and symbolic day for many of teenagers across the UK.

Today, the first few thousand teenagers will gain access to their Child Trust Fund, money which has been accruing interest for eighteen years. Child Trust Funds (CTFs) were a government scheme in which provided two £250 or £500 deposits (dependent on parental income) in a government approved bank or investment account for the child.

We're Helping 18 Year Olds To Receive A £1,000 Cash Boost!

With the first set of children with Child Trust Funds due to turn 18 on 1st September, many teenagers are set to miss out on their Child Trust Fund money which has been accumulating interest for nearly two decades. HMRC estimates that over 700,000 of the Child Trust Fund accounts originally set up have been ‘lost’ or forgotten about, meaning a significant amount of the money provided by the government will remain unclaimed.

At the Just Finance Foundation, we are on a mission to:

1) Ensure everyone is reunited with the money in their CTF

2) Ensure that CTFs are used wisely in this difficult financial climate

1,000 Church and Community Leaders to Be Trained to Help Those Facing Financial Difficulty

A major expansion of Just Finance Foundation’s COVID Cash Course is set to enable a thousand churches and community organisations to deliver information and resources that will help 10,000 people tackle financial issues that have arisen due to the Coronavirus pandemic, potentially preventing a downward spiral in their circumstances.

We're Fighting Back Against COVID-19

We wanted to take a moment to write and update you on the work the Just Finance Foundation are doing to battle the Coronavirus. The Just Finance Foundation, like many other charities, have been quick to respond with support to people effected by the Coronavirus.

So what have we been doing?

What Would You Do If I Gave You £15 Right Now?

What would you do if we gave you £15 right now?

Treat yourself? Save it for a rainy day? Invest it? Give it to a loved one?

What would you have done with £15 when you were younger?

Would this be any different?

‘I Wish I Learnt About Money At School!'

LifeSavers, our financial education programme for primary school children (KS1 and KS2), is now in it’s 4th year of delivery. Growing year-on-year, the programme now has 120 registered schools and we at The Just Finance Foundation (founders of LifeSavers) have ambitious plans to grow this number further!

Had Another Argument Over Monopoly This Christmas? Here’s Why:

If you’re like me and my family, monopoly is a staple board game at Christmas. If you’re even more like my family, it’s not uncommon for there to be an argument along the way. Typically, these arguments will regard

one or two players being lucky, one player acting arrogantly or the rules of the game itself being unfair.

Sound familiar? Well, Professor Paul Piff, a social psychologist, has illustrated that the way people in which people behave during a game of monopoly varies depending on how wealthy a player is.

£250,000 Grant Gives Financial Education to 8000 More Children

A £250,000 grant from Allchurches Trust will enable The Just Finance Foundation’s LifeSavers programme to provide financial education to thousands more primary school children, helping them to develop healthy money skills and habits at a key point in their lives.

A values-based approach to financial education: bringing meaning to conversations about money.

More and more organisations, schools and businesses are discovering the power of adopting and articulating a set of core values.

If everyone in an organisation shares the same values, then their energies are all channelled in the same direction. For businesses, some studies suggest that effective corporate values can generate up to 30 percent of difference in performance

Overcoming Shocking Debt – New Starter Begins for Talk Money and Talk Pensions Week

Gurj Shergill has recently joined the Transforming Communities Together (TCT) team as the new Overcoming Shocking Debt Worker. Gurj joins the fantastic Black Country branch of the Just Finance Foundation adding further to a team experienced and talented in addressing many aspects of financial capability.

'What Do Kids Know About Money?'

In the UK we are experiencing a period of uncertainty. With precarious incomes, ever-rising housing costs and unprecedented levels of indebtedness, distress, as a direct and indirect result of money, is epidemic across the UK. Currently, 11.5 million people in the UK have less than £100 in savings and nearly nine million of us are in serious debt (FinCap 2019). Yet money and personal finances can often be a taboo subject.

Starting conversations about money

Jesus Money is a new resource from the Just Finance Foundation and Transforming Communities Together.

Taking about money isn’t easy - especially in groups - we have created this resource to help break the ice - a simple and effective set of thought-provoking questions across four topic areas: SPEND, GIVE, SAVE, BORROW…