How can debt affect your mental health?

A study from the Royal College of Psychiatrists found that half of all adults with debt problems are also living with mental ill-health. This ranged from a consistent feeling of anxiety and low mood to a diagnosed mental health condition.

It is important to feel supported by people around you, whether that be friends, family, a creditor, a charity – anyone that makes you feel safe. Talking about your situation with a confidant creates a sense of release and relief.

Are you struggling to sleep?

Do you feel like your mood and energy are low?

Are your relationships with friends and family being negatively impacted?

If you answered yes to any of these questions, it might be time to consider:

Speaking to a debt advisor – some will help for free: StepChange, National Debtline, Debt Support Trust or Citizens Advice

Talking to someone you can trust, a friend or relative can help shoulder the problem

Money Helper to assist in locating online, telephone or face-to-face support in your area.

Finding out if you are entitled to a ‘Breathing Space’ – this is a scheme that can pause your debt – ask an advisor or your creditor about this. (video link - https://youtu.be/-V7LNpN9rSc )

Considering if you are eligible for a debt and mental health evidence form (DMHEF) – this is available when you speak to your doctor about your situation and how it affects your mental health.

Remember you can end a discussion at any time – It is ALWAYS your choice to share information.

“Around one in four adults in the UK experience a mental health issue in any given year.” Debtline.org

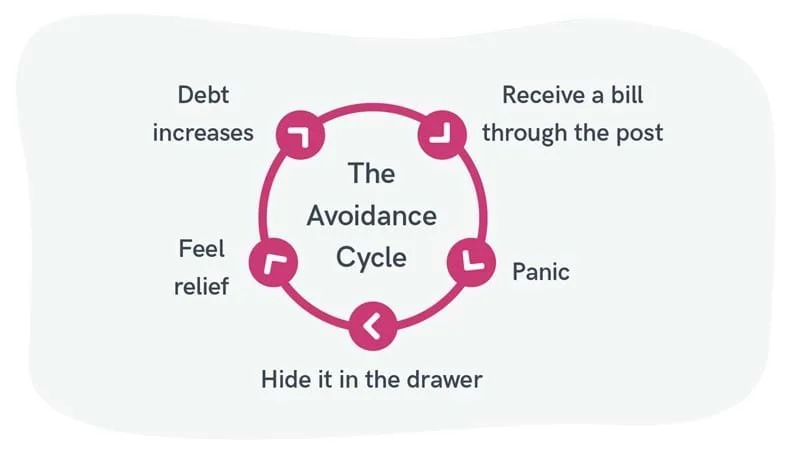

What is a Debt Cycle?

Continual borrowing that causes debt and costs to increase.

Debt can appear when you spend more money than you bring home.

The costs of borrowing, including interest and overdraft fees, can become an expense of their own

Your debt increases as you try to keep up with even the minimum payments.

For information on debt support visit our help hub – Debt Support